Contents

MyCoverageInfo Loan Search is a cutting-edge web resource for locating and contrasting potential loan programs. MyCoverageInfo Loan Search streamlines the process of finding the right loan for your unique circumstances, whether you need a personal loan, mortgage, vehicle loan, or another kind of loan altogether.

Loan Search simplifies comparing several loan companies, APRs, and other terms and conditions. The website compiles information from several lenders to access various choices in one spot. You only have to contact several financial institutions or visit their websites to compare rates and terms.

MyCoverageInfo Loan Search also provides valuable tools and information to ensure you make the best possible choice. Given various loan periods and interest rates, the loan calculator may help determine how much you will owe monthly. The portal also includes guidelines and tutorials to assist you in learning about loans, financial terminology, and how to raise your credit rating.

Read on to explore everything!

About Coverage Inc.

Located in Chantilly and Williamsburg, Virginia, Coverage, Inc. provides insurance services for individuals, businesses, and employee benefits. Aside from providing insurance solutions, Coverage, Inc. also offers independent insurance coverage.

The company provides social security coverage for individuals, professionals, and businesses in Williamsburg, Virginia, and surrounding areas. Programs of special interest: workers’ compensation. As an insurance agency, the agency provides customers with fast and professional service regarding auto, home, business, and life insurance following their personal needs.

A key objective of the company is to provide clients with advice and products to help them manage their most valuable assets. In addition to managing homes, cars, businesses, and investments, clients use products to manage their companies’ finances. Coverage, Inc.’s goal is to build lasting relationships with customers and meet their needs no matter what stage of life they are in.

How to Check Your Loan on MyCoverageInfo?

Through the MyCoverageInfo portal, you can update your loan and insurance policy information. If necessary, the portal will notify the insured or agent once your insurance policy is updated. Here’s how you can find your credit and update your insurance info:

- Visit www.mycoverageinfo.com to log in.

- Check out MyCoverageInfo at https://MyCoverageInfo.com to find your loan.

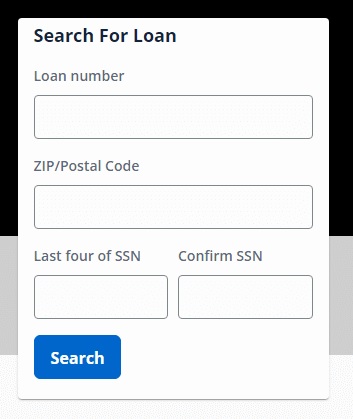

- A Search Loans section can be found on the right side of the MyCoverageInfo home page.

- No pin is required so you can enter your rental number instead. Loan numbers appear on loan applications or monthly statements.

- Identify your loan document by entering its zip code.

- Input your SSN (Social Security Number) last four digits.

- Confirm your entry by entering the four digits again.

- Enter and update your info by clicking Search.

- With MyCoverageInfo, type in your agent info, insurance info, personal information, loan info, and more, so your insurance will be checked automatically.

MyCoverageInfo Loan Insurance Coverage

MyCoverageInfo Loan Search additionally provides a full menu of insurance-related services. This site is a one-stop shop for locating and comparing the best insurance policies for your requirements, whether you’re shopping for car insurance, house insurance, health insurance, or something else. MyCoverageInfo Loan Search’s insurance coverage information may be accessed in the following ways:

- Log in to your MyCoverageInfo Loan Search Account: Sign up for an account by giving basic information about yourself and creating a password. You may use the platform’s tools and resources after you’ve signed in.

- To access the insurance information: You must go to the “Insurance Coverage” or comparable page or section. It might be on the primary dashboard or the primary menu. To continue, choose the relevant menu item.

- Choose the appropriate form of protection: This section lets you choose the policy options that best suit your needs. Insurance for vehicles, homes, tenants, medical expenses, and lives are all common choices. To continue, choose the most functional group.

- Input your insurance information here: The details of the insurance protection you need will need to be specified. The required specific information may change from one sort of insurance to another. For instance, if you’re in the market for car insurance, you may be asked questions about your motor vehicle, your driving record, and the coverage you’d want. If you’re shopping for homeowners insurance, you can be asked for information regarding the property’s location, value, and exceptional protection requirements.

- Define the necessary levels of protection: It’s possible to tailor your coverage needs to the specifics of the platform you’re using. Deductibles, liability limitations, and optional coverages may all be tailored to your needs and budget.

- Consider your insurance choices: When you use the MyCoverageInfo Loan Search system to submit your insurance information, it will provide a list of policies that meet your needs. Think about how much coverage you need, how much you can afford each month, and how much more your insurer will throw in regarding features and perks.

- Evaluate different insurance companies: The portal may provide information for comparing various insurance plans. Consider their financial security, previous client feedback, and market standing. The insurance company you choose should be one you can put your faith in.

- Check out these supplementary readings: You may find extra information and tools in MyCoverageInfo Loan Search. Insurance guidelines, definitions of keywords, frequently asked questions, and advice on locating the most suitable policy are all examples.

- Please choose an insurance plan: Pick the best insurance plan that fits your needs after researching. Consider price, coverage limitations, customer service, and your unique requirements.

- Make a call to your insurance company: After making your choice, you may contact the insurance company directly to begin the application process or get any more information you need. The platform may include the insurer’s contact information or a link to the company’s website.

Conclusion

Loan seekers and insurance policyholders may benefit from MyCoverageInfo Loan Search, a comprehensive online platform. This platform streamlines the search for a loan or insurance to safeguard your possessions by giving you access to various possibilities and making it easy to compare them.